EDI Validation Done Right with Cloud-Based Solutions

4min read

Article

EDI validation is the process of making sure two companies can successfully trade EDI documents following specific guidelines they have both agreed upon. It’s typically a tedious, time-consuming process, but it doesn’t have to be. With the right approach and technology, it’s possible to streamline virtually every aspect of EDI validation and get to market faster.

We will use a simple example to walk through the typical EDI validation process and then explore how you can streamline the process and automate EDI tasks to save time and money.

Let’s imagine a shoe manufacturer just got the green light to sell its new shoes to a big-box retailer, and the big-box retailer requires the shoe manufacturer to set up an EDI connection in order to do business. In this example, the retailer has the power in the relationship, we will call them the “Leader”. The Leader will set the EDI rules and dictate how they want to trade data. The manufacturer will be required to follow these rules so we will call them the “Follower”. The leader gives the follower their EDI guideline, which outlines which documents are needed, the format, how to communicate the documents, and any other details specific to that leader. For example, the guidelines may indicate how the manufacturer should submit its invoices (EDI 810). These requirements may stipulate how the manufacturer should format such details as dates, billing addresses, and product descriptions. They may also require specific payment terms and carrier details. If the manufacturer deviates from any of these requirements, the invoice will be rejected and the manufacturer may not get paid. It’s very important for both parties to work together to validate or practice sending EDI transactions prior to going live. Once alive, transactions must be monitored to ensure they are flowing smoothly.

This sounds simple enough, so why has it been taking companies over 8 weeks to validate and test transactions before going live? Let’s take a look at the current process.

Problems with the Current EDI Validation Process

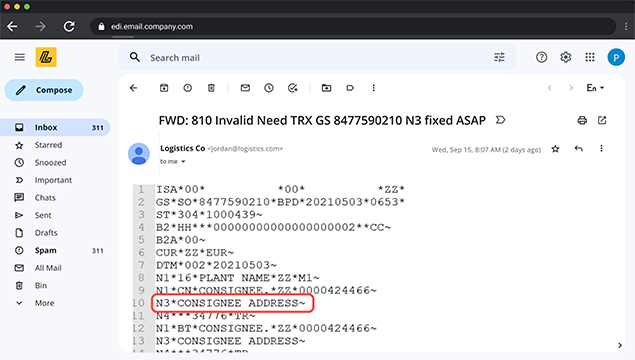

The current EDI validation process relies heavily on humans and is very error prone. In fact, it’s common for both leaders and followers to have full teams devoted to EDI validation and testing. Today, the most common process for EDI validation consists of files being emailed back and forth, while humans review these complex EDI files, mark-up the errors, and return them to the follower to correct and try again. Depending on the responsiveness of both parties and the resources available, it can take two to eight weeks to complete this process. That means it could be months before the shoe manufacturer can receive their first order from the big box store resulting in delayed and or lost revenue.

Let’s review the current process in a bit more detail. The Leader will share EDI requirements with the follower, typically as a PDF document. Both companies must agree on these rules before they can begin sending transactions. The follower must interpret the written guidelines into code that maps their data into the format the Leader is requesting. Once that is complete, they can send a sample transaction to test to see if the information is indeed correct. The stakes are high: if the follower doesn’t meet requirements during testing, the leader can prevent them from going live, thus delaying ordering products from them.

Once the follower has the data mapped, they are ready to begin testing. During the testing phase, both parties will send test data back and forth. The leader will typically respond by phone or email to tell the follower whether their transaction went through correctly. If the transaction fails, the follower then must go back and fix errors—and the feedback loop will continue until the leader decides it’s safe to go live. A typical trading partner will trade 4-6 documents on average, so this back and forth process will be repeated until each document is validated.

Once both parties are satisfied with the validation tests, the trading relationship can go live. However, because these files are validated by a human, it is not uncommon to find errors once live transactions are being traded. If the follower doesn’t meet the leader’s requirements on live transactions after going live, the leader will reject their transactions. In many cases, they will also apply chargebacks for submitting incorrect data.

When a leader rejects a live transaction due to a missed or untested requirement, it can take considerable time for the follower to identify and correct the error. In the meantime, all their live transactions may be subjected to rejection and/or chargebacks until they fix the root cause of the error. Delayed orders and chargebacks can increase quickly and jeopardize profit margins.

As you can see, today’s antiquated process of validating EDI transactions has several problems:

- Dedicated resources are required for validation and testing

- Back and forth manual reviewing and communication increases time to onboard

- Lack of automation makes the validation process error prone

- Financial impact is caused due to delayed Go-Live

- Loss of goodwill and reputation results from delays and errors

Streamlining EDI Validation with a Modern Cloud Solution

How can a modern cloud EDI solution help these partnerships streamline the EDI validation phase and get to market faster? It starts with eliminating as much of the manual processes as possible, electronically catching errors before files are sent, and providing easy-to-use tools to correct problems quickly. Let’s take a look at a modern approach to EDI validation.

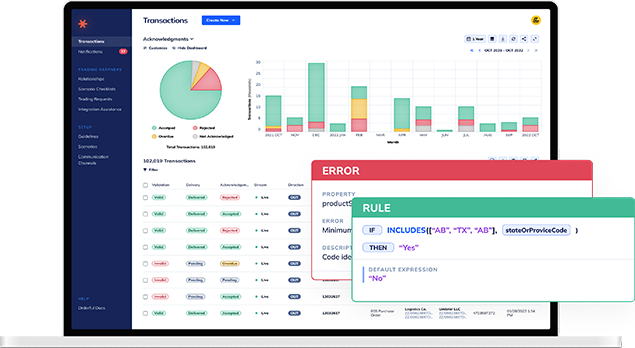

To eliminate the manual process of reviewing EDI documents against paper requirements, EDI guidelines must be digitized. That means entering the leaders guidelines, rules, and requirements into a cloud based EDI system. This digitization process should take approximately 2 days. Once complete, followers can send data to the cloud solution for validation against the leader’s specification in real time. Real-time validation allows errors to be caught and fixed quickly without the back and forth emails previously required. This step alone eliminates the need for humans to review EDI files manually and reduces the back-and-forth emails by over 80%.

Because guidelines provided by the Leader can sometimes be vague or incomplete, followers may still need to send the cloud validated documents to the leader for final approval. Once approved the partners can go live and begin trading.

Once the partnership is live, a cloud based EDI solution needs to stop invalid transactions from being transmitted, preventing chargebacks and damage to the relationship. The solution should provide reporting and notifications for all transactions. For invalid transactions, it should outline what needs to change, and provide tools to make quick changes so that the partner can correct the transaction in the system and resume business quickly.

Moving to a cloud based EDI solution can streamline your EDI validation process by decreasing the time and resources needed during testing, eliminating chargebacks, and most importantly get you to market faster resulting in increased revenue.

Consider Orderful for EDI Validation

If you’re looking for a reliable cloud EDI solution that can help you streamline EDI validation, consider Orderful. Orderful customers are seeing up to a 80% reduction in onboarding costs when setting up new trading partnerships. Orderful digitizes trading partners’ requirements, automates testing, and validates EDI transactions in real time. Additionally, Orderful provides real-time notifications and an easy-to-use business rules engine to fix errors quickly and keep your business moving.

Orderful is reimaging EDI – see it for yourself. Request your Orderful demo today.

Go live with new trading partners in days, not months. Orderful’s modern EDI platform standardizes integrations and streamlines testing, getting your business connected with partners 10x faster than other solutions.

Learn More

Join us on the journey to change the way the world trades EDI

Talk to an EDI Expert today

Join us on the journey to change the way the world trades EDI